2. 清华大学深圳国际研究生院,广东 深圳 518055

2. Tsinghua Shenzhen International Graduate School, Shenzhen 518055, China

系统性金融风险指可能危及整个金融体系稳定的风险。国际实践表明,系统性金融风险不仅危及金融稳定,更会给宏观经济和社会财富造成巨大损失。系统性金融风险表现形式有多种,其中最典型的要属金融危机。从17世纪至今,金融危机在世界各国不断爆发,其发生频率和破坏性有增大趋势。目前,全球金融市场仍处于恢复、调整期,但国际金融形势依然非常严峻。更为重要的是,在经济全球化的趋势和背景下,外生性金融风险的发生概率和危害程度急速增加。

近年来,我国科技进步催生金融新业态不断创新发展,以数字金融为例,第三方支付服务已经开始取代传统金融部门的服务,在网络贷款、智能投顾、数字保险等领域也取得了显著进展。但同时,包括借贷违约、资金挪用、虚假标的甚至欺诈行为在内的各种风险因素也相伴而行,我国金融体系内生性风险明显上升。基于互联网技术的特性,风险极易在不同部门和地区之间形成传染性,并有演变为金融风险的可能。在这一背景下,着眼于先知先行的金融风险预警技术研究具有极高的理论和应用意义。

然而,实践中对金融风险的预警难度极大。传统金融风险预警技术为什么没有很好地做出有效预警,其中一个重要原因是缺乏有效及时的关键因子。学术界与工业界也均有特征决定模型上线的说法。传统金融风险预警技术在因子层面倚重基于传统统计数据的信息和因子,其本身就具有滞后性,客观上对金融风险预警不利。进入大数据时代,海量非结构化信息的涌现为金融风险预警在扩充不可多得的基础信息层面提供了机会;而人工智能在视觉、自然语言理解等感知认知领域的发展则为挖掘这些信息从而最终形成有效及时的金融风险预警关键因子提供了必不可少的技术支持。

从多源异构的信息中提取及时有效的风险感知因子,将倚重多模态信息感知认知技术。按信息存储方式可以将大部分基础信息分为图像信息与文本信息;这两类信息的挖掘方法分别对应图像处理技术和文本挖掘技术。

对于图像类信息,可以综合利用卫星图像识别技术、光学字符识别(optical character recognition, OCR),结合自然语言处理(natural language processing, NLP)等技术完成信息提取。如可从超高分辨率卫星图像中识别农作物、航运货物、海陆运输等目标,进而对经济生产重要环节走势变化做出预警[1];可使用OCR技术从财务票据、交易票据等非标准信息中提取用于风险审核的重要信息[2];而夜间灯光遥感数据则可用来动态预测人口密度、城市扩张速度[3-4];此外,声纹识别技术可用于增强金融应用场景的安全性,提升交互体验效果等[5]。

对于文本信息内容,可以利用自然语言处理(NLP)结合机器学习等技术完成信息提取。如可以从新闻、舆情、论坛资讯类文本数据中实时识别金融实体、发现金融事件的关联关系,提取刻画经济不确定性等的相关因子[6-12]; 从上市公司年报、首次公开募股(initial public offerings,IPO)招股说明书和公司前瞻性陈述类文本数据,挖掘企业收入、业务发展规模、公司发展战略倾向等信息[13-18];也可从社交媒体类文本信息中,包括推特、微博、微信公众号和论坛帖子等,提取事件倾向评分、关注度指数、风险波动率等因子[19-21]。

然而,图像及文本信息作为新数据源具有多源、异构、海量、高频的特征,处理这类信息技术难度较大。1)多源、异构:相对于主要由政府和机构主导收集的传统数据,图像及文本大数据的发布主体及具体形式均丰富多样。非结构化信息没有统一的收集标准和收集格式,这给人工智能(artificial intelligence, AI)信息采集和数据预处理技术提出了较大的挑战。2) 海量:受限于数据收集成本,传统数据收集往往需要借助纸质媒介,体量较小。随着文本信息从纸质媒介向以互联网为媒介的方式转移,文本数据收集和传输成本大幅度降低,每日都能产生百万兆(terabyte, TB)级数据。从海量的数据中筛选并提取出关键有效因子,这既是信息处理的重点也是难点。3) 高频:传统金融领域数据多为年、季、月、周度数据,而图像、文本大数据的频率可以高达秒级甚至更高,这就对非结构化信息的处理速度提出了更高的要求。

上述特征综合在一起使得将非结构化大数据应用于金融风险预警领域面临着一个核心挑战,即如何准确、有效地从混杂的多源、异构、高频数据中提取出对风险预警有价值的信息。围绕这一问题,本文首先梳理了人工智能技术处理非结构化大数据,进而将其应用于金融风险预警的全流程,并着重说明了感知认知技术在其中的作用。

1 感知认知技术研究进展 1.1 基于图像处理算法的感知技术研究进展将多源异构信息应用于金融风险智能预警的过程如图1所示。首先利用网络爬虫技术从新闻、图片、视频、微博和语音等信息源收集信息,形成多模态信息池;之后利用智能感知认知技术对图像和自然语言进行层层处理,加工出关注度、情绪指数、预期指数等因子;最后根据计量经济学、统计学等方法构建风险预警模型,以此预测及解释金融风险。其中第二步感知认知技术是第三步建模的基础,更是现阶段有效提高金融风险预测精度和时效性的必要且重要手段;而第三步在计量经济和统计领域已有较多文献予以论述。因此,本文着重就第二步的感知认知技术及其在金融风险预警领域的应用进行系统综述,简要介绍近几年预测模型相关的研究进展。

|

Download:

|

| 图 1 金融信息提取及应用步骤 Fig. 1 Steps for financial information extraction and application | |

用于金融风险预警的很多基础信息蕴藏在模态各异的海量影像数据源中,目前感知技术主要用来从这些数据源中提取有效信息进行身份核验,或者提取文字信息为信息认知提供数据基础。这些信息是提高预测模型精度的必要基础,可以有效克服金融数据感知不全、认知不准导致的模型失效等技术难题。如可以从社交、电商等应用平台的大量图片中提取产品类型、生产厂商、价格、评论等信息,进而萃取品牌关注度指数、企业产销量景气指数等高能因子;从遥感数据中提取农作物种植面积、生长情况等信息,从而可以对农业产量做出预测;从夜间灯光影像数据中挖掘城市扩张、人口密度及土地利用信息;对银行视频进行实时分析,识别客户身份和行为特点,及时阻断相关风险;应用OCR+NLP技术识别客户的各类材料,降低贷款审批风险、提高审批效率等。

图像处理算法自深度神经网络深度应用以来得到了快速的发展,目前已经形成了三大通用技术——目标检测、目标识别、光学字符识别(OCR),并基于此发展形成了图像语义分割、形态识别、视频跟踪等细分技术类别。本节首先对各类图像处理技术进行综述,并在第2节针对性介绍它在经济金融领域的主要应用。

1)目标检测算法

目标检测(objective detection)的主要任务是从图像中定位感兴趣的目标及其类别,它是许多其他高级计算机视觉任务的基础,如实例分割[22-25]、图像字幕[26-28]、目标跟踪[29]等。目标检测算法发展过程如图2所示。

传统目标检测大多基于手工设计的特征,算法性能的提升主要依赖各种加速技巧来减少计算成本,代表方法有Viola-Jones(V-J)探测器,可变形部件模型目标检测算法(deformable parts model,DPM)等[30-32]。基于深度学习的目标检测可以分为两大类:two-stage和one-stage。前者基于候选区,检测框“从粗到细”设定,后者基于回归方法,检测框“一步完成”。two-stage类的代表方法包括区域卷积神经网络(region-based convolutional neural networks, R-CNN)[33] 、空间金字塔池化卷积网络(spatial pyramid pooling convolutional networks, SPPNet)[34] 、快速区域卷积神经网络(fast region-based convolutional reural network,Fast R-CNN)[35-36] ,其他改进的方法有深度残差网络(deep residual network, ResNet)、超网络(hypernetwork,HyperNet)[37-41]等。two-stage方法通常在准确度上有优势而在速度上存在不足。与之相对,one-stage方法通过单次检测即可直接得到最终的检测结果,因此具有更快的检测速度,但定位精度有所下降。one-stage方法主要有YOLO(you only look once)[42]和单激发多框探测器(single shot multiBox detector,SSD)两类。以YOLO为基础的YOLO V2~V4[43-45]系列算法重在研究如何提高预测精度,其他改进的算法有Fast YOLO[46]、Complex YOLO[47],POLY YOLO[48]、PP-YOLO[49]等。SSD[50]利用多尺度特征图进行目标检测,在保证检测速度的同时有效提高了检测精度。在SSD基础上改进的算法有反卷积单激发探测器(deconvolutional single shot detector,DSSD)[51]、密集连接卷积网络(densely connected convolutional networks ,DenseNet)[52]、RSSD(rainbow single shot detector)[53]、M2Det(multi-modal multi-channel metwork)[54],RefineNet[55]、特征融合单发多框检测器(deep fusion based single shot multibox detector , DF-SSD)[56]、增强型SSD[57]等。

|

Download:

|

| 图 2 目标检测算法发展历程 Fig. 2 Development history of object detection algorithm | |

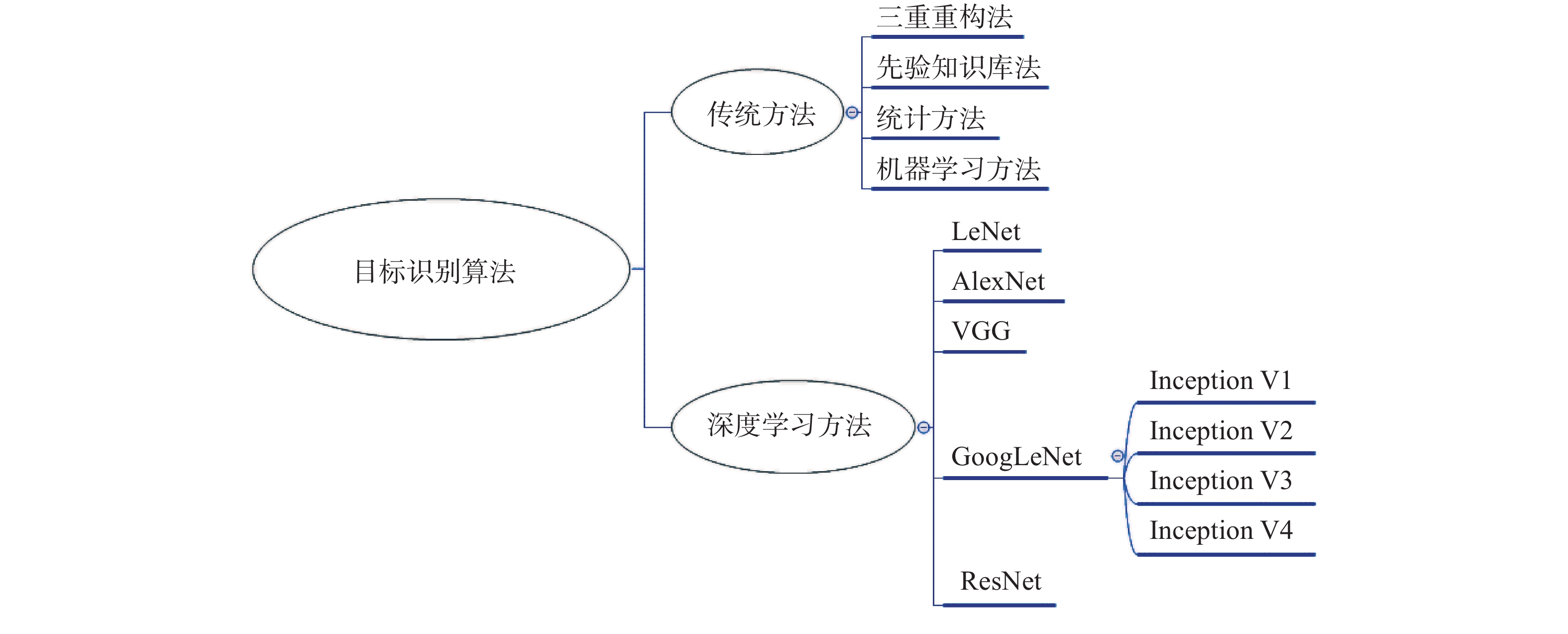

2) 目标识别算法研究进展

目标识别(objective recognition)的任务是识别图像中可能未知分类的目标及其分类[58],其技术发展过程如图3所示。

|

Download:

|

| 图 3 目标识别算法发展历程 Fig. 3 Development history of object detection algorithm | |

目标识别算法目前主要以深度学习方法为主,其中LeNet-5模型[59]第一次将LeNet卷积神经网络应用到图像识别分类上,在手写数字识别任务中取得巨大成功。Krizhevsky等[60]提出了深度卷积神经网络AlexNet模型,其预测精度显著高于同期其他算法。随后,出现了大量改进的算法,包括VGG(visual geometry group)[61]模型、GoogLeNet 算法[62]、Inception V3[63]、Inception V4[64];ResNet模型[37]等在精度及运算效率上均有一定的提升。其他类似的研究包括Chen等[65]、Alom等[66]。

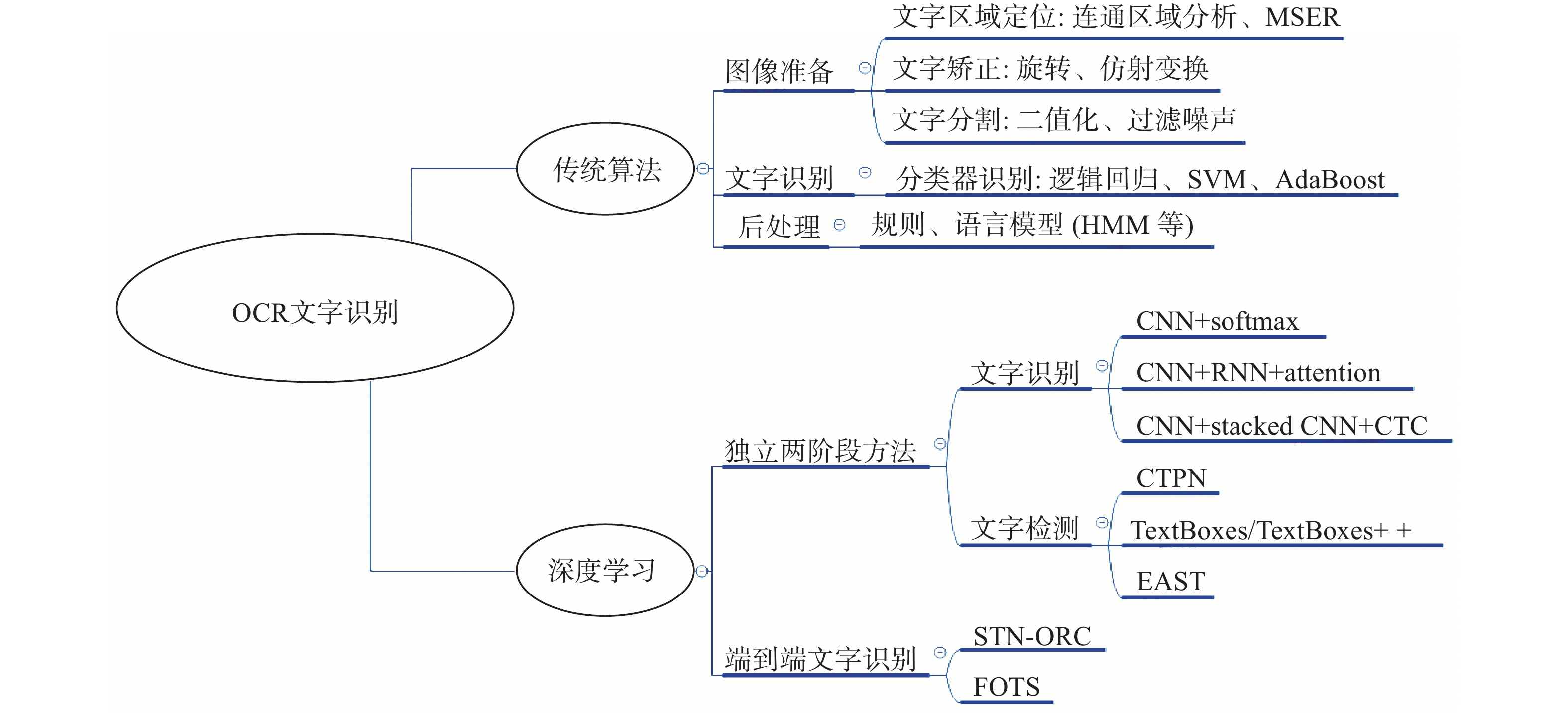

3) OCR 文字识别技术

2012年OCR领域也引入了深度学习的思想——使用卷积神经网络来取代传统的手工特征设计。深度学习OCR方法主要分为独立两阶段方法和端到端的文本定识方法。独立两阶段方法会对文本检测和文本识别进行单独建模,对一般复杂场景下的文本识别表现良好。其主要发展历程和算法分类如图4所示。

|

Download:

|

| 图 4 OCR 文字识别发展历程 Fig. 4 Development history of OCR text recognition | |

基于深度学习算法的OCR技术主要涉及文本识别算法和文本监测两类算法。文本检测方法以SSD、CTPN[67]、DBnet[68]为主,文本识别算法通常基于LSTM+CTC[69]技术、attention[70-71]来实现。“端到端”文本定识主要基于下列方法来完成:CNN+RNN+CTC[72]、CRNN+LSTM [73]、基于循环神经网络的OCR[74]、基于多语言多路复用网络的OCR[75]。

4) 其他图像处理算法

其他用于金融风险领域的感知技术还包括图像语义分割、目标跟踪类算法。语义分割从像素级别来理解图像,需要识别图像中的每一个像素点而不仅仅是矩形框。TextonForest[76]和基于随机森林分类器[77]等语义分割方法是较为常用的传统方法。目前基于深度学习的语义分割方法有U-net、空洞卷积、条件随机场、DeepLab系列方法、弱监督的语义分割方法[78-88]等。目标跟踪的目的是将多帧检出的目标串联起来。传统目标跟踪方法主要通过核相关滤波来实现目标跟踪[89-92];基于深度学习的跟踪算法则是把网络学习到的特征直接应用在相关滤波或Struck跟踪框架中,跟踪结果良好[93-95]。

1.2 基于自然语言处理技术的认知智能理论和技术发展认知智能技术提供了提取非结构化文本数据中有效信息的方式,可有效提升后续模型的预测精度,丰富非结构化数据在金融建模领域的应用。例如:可以利用论坛、研报中大量对资本市场的评论与分析言论等信息提取关注度指数、后市预期指数等有效因子,充分挖掘市场情绪信息在金融风险预测中的应用;还可以从海量的非结构化数据中提取有效实体,发现实体之间的关联信息,构造金融知识图谱,并将其应用到金融风险预警中,有效地根据风险的传递链提升金融风险的预警精确度与效率。

认知智能算法伴随着深度学习网络的应用获得了极大进展,它主要由特征编码、特征提取、知识图谱3个模块组成。特征编码模块主要将非结构化的文本数据转化为模型可输入的特征数据,其具体的编码方式包括ONE-HOT编码、词嵌入编码、ELMO(embeddings from language models)动态模型编码等。使用特征编码模块得到的词嵌入编码可将一段文字变为数字化的张量(其维度通常为字符数×词嵌入编码维度),文本特征提取模块以此为输入,进而使用长短期记忆(long short-term memory, LSTM)、Transformer等序列处理模型进一步提取文本语义信息。在前2个模块的基础上,NLP模型可根据不同的任务设置不同的输出层,其任务包括文本分类、文本蕴含、阅读理解、实体识别等。知识图谱则可用于解决金融风险知识存储与推理等问题。本节将对主要的文本认知处理技术及其应用进行综述。

1)文本特征编码模块

文本处理所面临的首要任务就是将文字进行数字化表示,以达到模型可输入的目的,即自然语言处理技术中的特征编码模块。ONE-HOT编码是自然语言处理中出现最早、最基础的编码方式,它为词表中的每一个词分配一个独有的状态(编码),从而将一段文字转变为稀疏矩阵。ONE-HOT仅适用于小型词表并容易产生维度爆炸。Word2Vec[96]是第一种高效可用的词嵌入方法,其基于语言模型,采用CBOW与Skip-Gram两种编码框架,产生的词嵌入向量稠密且维度固定,性能较ONE-HOT编码有巨大提升。在Word2Vec之后,FastText[97]引入字符级别的编码信息,将字符信息与单词信息分别编码后进行拼接表示。GLoVE[98]编码则利用共现矩阵同时考虑局部信息和整体信息。但这些编码方式的改进并没有脱离Word2Vec的框架范畴。ELMO[99]是另一个具有划时代意义的编码方法,其最大的特点是采用动态词向量表示,编码架构使用多层堆叠的LSTM来结合词法与语义特征,基于预训练模型+模型微调的方式,其词向量根据不同的上下文动态变化,可有效解决一词多义等任务。

2)文本特征提取模块

文本特征提取模块是认知模型架构中最重要的部分。文本特征提取模块性能的好坏将直接影响认知模型最终的性能。本节将介绍自然语言处理中用来进行文本特征提取的主要算法。

① 基础模型

循环神经网络(recurrent neural network, RNN)是一种主要为序列问题设计的深度学习网络架构,其结构易导致反向传播时产生梯度消失和梯度爆炸,使最初的序列输入对当前时刻影响减弱,容易引起信息变形,给模型带来大量干扰信息。LSTM[100]改进了RNN的网络结构,采用“累加”替代原始RNN中“累乘”的状态计算,在保留RNN优点的同时缓解了梯度爆炸与梯度消失问题[101]。在此基础上,门控机制的引入[102]有助于模型合理控制信息流,解决了信息变形与长期依赖问题。上述模型均须串行处理因而开销较大,直到Transformer[103]出现,其采用了自注意力计算方式,特殊的架构能同时处理全部的嵌入向量:它利用当前特征前后的所有信息计算注意力参数,利用位置编码解决编码输入向量相对位置关系的难题,并引入残差连接来控制信息流向,利用前馈网络层对信息进一步处理。

② 注意力机制

在NLP领域,Bahdanau等[104]首次在机器翻译任务上引入了注意力思想,将翻译和对齐任务同时进行,极大地提升了机器翻译模型的性能。在此后,注意力机制被广泛应用于NLP相关模型中。Hu[105]说明了其一般流程为利用注意力权重衡量序列中每个特征对当前任务的重要程度,并将注意力放在重要性更高的特征上面。不同的模型会采用不同的注意力权重计算方式,但本质均不会脱离上述架构。

③ 预训练模型

随着基于变换器的双向编码器表示技术(bidirectional encoder representations from transformers, BERT)[106]的出现与应用,预训练模型成为认知智能领域主要的研究方向。BERT以Transformer为模型基础架构,以改进的遮蔽语言模型[107]加下一句话分类判断为优化目标。预训练模型采用无监督的方式在超大规模语料上训练得到,可应用开放领域学习的先验知识来提升下游任务的性能,对小数据集友好。

在BERT出现前后均有相应的预训练模型出现。在BERT之前有ELMO[99]和GPT[108],但它们都未曾引入双向编码器。在BERT出现之后,RoBerta[109]丢掉了BERT中的下一句话预测任务并扩展了训练数据量。XLNET[110]提出了多层感知器(multilayer perception,MLP)置换语言模型,以解决BERT遮蔽语言模型训练集中mask标志带来的训练与应用数据分布不一致的问题。MASS[111]和T5[112]采用了seq2seq MLM的训练目标以解决BERT在序列生成任务上性能不足的问题。ERNIE[113]引入了实体和短语的mask机制,增强了模型的语法学习能力。Big Bird[114]、ConvBERT[115]则通过更加关注临近区域信息缓解了BERT全注意力机制带来的序列长度二次依赖局限。此外,模型变大也是一种趋势。GPT-3[116]将模型参数扩展到1750亿,数据扩展到45 TB,作为对比,BERT-large有3.3亿参数量。

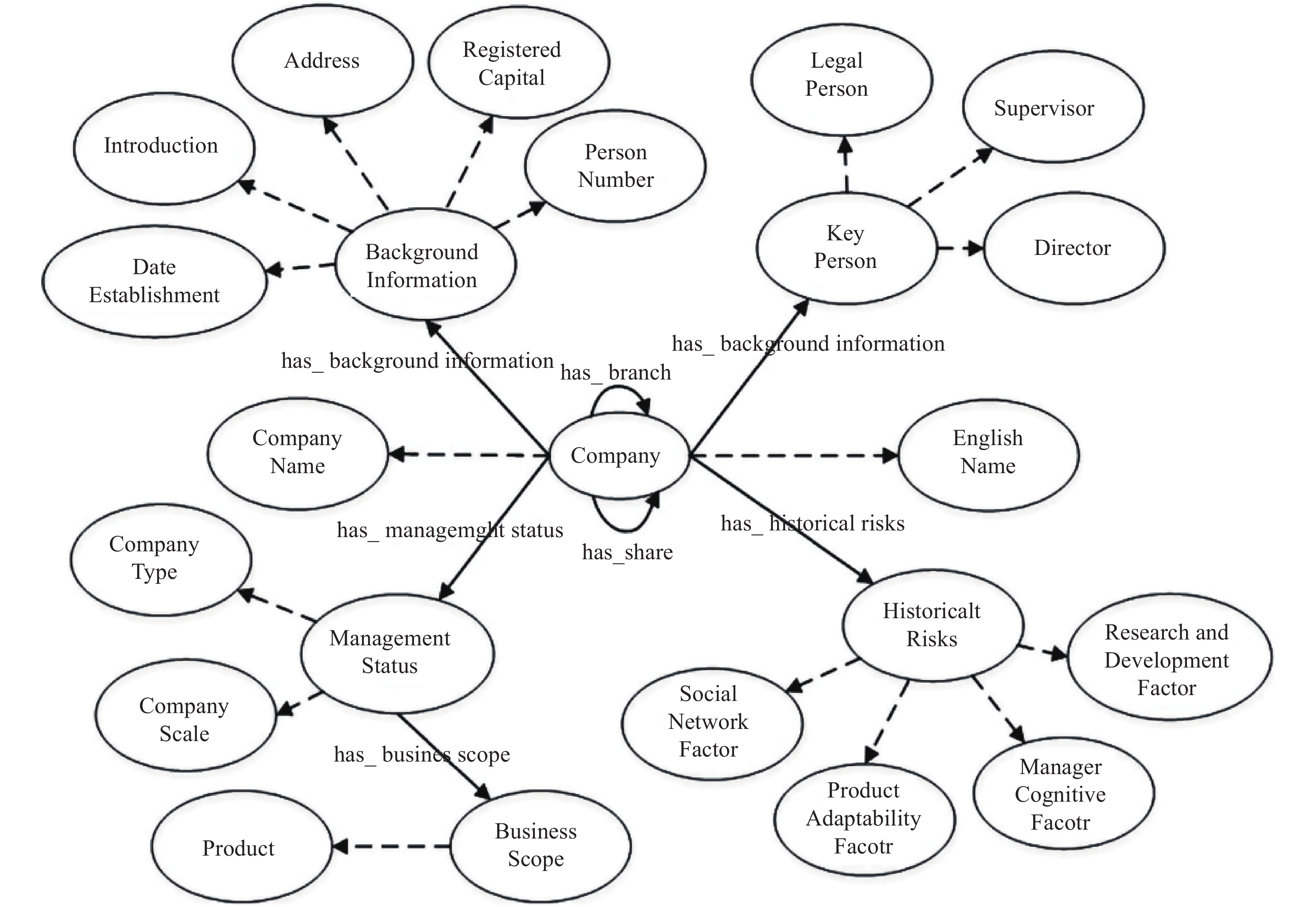

3)知识图谱模块

认知智能中常以知识图谱作为大规模数据的组织形式。知识图谱是一种基于图的数据结构,由节点(point)和边(edge)组成,每个节点表示一个“实体”,每条边为实体与实体之间的“关系”。金融知识图谱中的关系实例有企业和人的关系(法人、管理者)、银行账户和银行的关系、银行账户和人的关系以及企业和地址的关系等。

如图5所示,该知识图谱[117]可以用来规范地表示企业实体、关系以及实体的属性和类型之间的联系。每个企业本体拥有4个企业属性:基本信息属性、经营状态属性、相关人员属性和历史风险属性等,企业间的关系可以分为参股、投资和交易关系,人与企业间存在掌控、任职或参股关系,人物之间又有下属和朋友之类的社会关系。在企业领域本体资源描述框架(resource description framework, RDF)的基础上可以构建企业动态风险知识图谱:边包含实体间的关系和关系的起始时间,用以预测高风险行业和风险事件来帮助企业尽早规避系统性风险;也可以加入企业现金流等属性,通过深度学习的方法实时监控属性值及其衍生指标,达到完善企业风险预警体系的目的。

|

Download:

|

| 图 5 企业领域的知识图谱本体RDF示例 Fig. 5 RDF example of knowledge graph in the enterprise domain | |

图像处理方法随着图像采集技术的发展,在社会经济各方面有了深入应用,并为风险预警提供了及时有效的因子。下面以汽车销量下滑为间接诱因导致股票价格下跌为例说明感知认知技术在金融风险预警中的应用。

如图6所示,利用感知认知技术可以从多类数据源中提取先行特征明显的直接诱因指标。例如从遥感影像中提取农作物的种植面积、受灾面积及严重程度等信息,这些信息同卫星云图反应的天气信息融合可以准确预测橡胶产量。利用类似技术同时可以提取航运信息,用以测算原油产量,进而结合油价关注度指数、油价预期指数可以预测原油价格走势。基于预测的橡胶产量及原油价格走势,可以准确测算汽车消费成本及汽车销量。如果汽车销量出现明显的下滑,必然会导致产业景气下行,进而对整个行业产生影响,最终引致行业股票下跌风险。从上述实例可以看出,感知认知技术是提取风险诱因信号的必要技术,对风险预警模型效果的提高,特别是预警及时性的提高具有重要作用。下面首先对感知技术在多类信息提取中的应用进行综述介绍。

在图像和视频信息提取方面,Birogul等[118]利用YOLO算法提取K线图信息,对股价进行预测。Wang等[119-120]将Mask R-CNN用于预测区域范围内的原油产量。这些预测结果可有效服务于资本市场的风险预警。Chen等[1]将基于卷积神经网络的图像商标识别与使用自然语言理解模型的上下文品牌识别结合起来,构建了多模态融合框架解决品牌识别问题。文献[121-124]研究了从图像和视频文件中准确提取人群数量、推断人群密度的高精度方法。感知技术的另一大应用为从遥感影像中提取农作物产量、城市土地利用等相关信息,与金融知识相结合后可有效用于风险传导预警等目的。如Chen等[1]综合利用多个目标检测算法基于卫星遥感图像,针对台湾病虫害对农作物产量的影响给出了量化评价。Yang等[125]通过自动合成带有标签的数据集,利用大豆种子图像对高产量的大豆进行筛选分类。Safonova等[126]利用无人机对棕榈树拍照,通过深度学习的方法检测棕榈树的生长和健康情况。Zhang等[127]开发了大豆叶片病害综合图像数据集,并通过检测模型对大豆叶片多特征进行分析,从而检测大豆叶片的病虫害问题。此外,基于遥感影像数据还可以用于建筑物识别,进而对城市发展进程、土地利用情况进行推断。Griffiths等[128]利用R-CNN方法基于遥感信息对建筑物进行了自动检测和分割;Tiede等[129]利用Mask R-CNN方法基于高分辨率卫星图像识别了120万个住宅和建筑物。

|

Download:

|

| 图 6 感知认知技术在金融风险预警中的案例 Fig. 6 Case of perceptual cognitive technology in financial risk early-warning | |

此外,对城市夜光数据(DMSP/OLS)的应用也依赖图像处理技术,而夜光数据经加工可作为区域经济发展情况等的侧面指标。Yu等[130]提出了一种提高DMSP/OLS的夜间灯光时间序列(nighttime light time series, NLT)图像应用精度和通用性的方法,探索了一种将人口定量空间化到网格单元的可行方法。Kumar[3]通过分析DMSP-OLS获得的1992-2013年夜间灯光数据,量化了北京城市化的像素级时空格局和趋势。Zhong等[4]基于DMSP/OLS研究了长江经济带城市体系空间格局,分析了长江经济带空间结构特征和规律。Zhang等[131]使用DMSP/OLS的多时相夜间灯光(NTL)数据来监测全球范围内的城市变化,提出了全球性城市化动态空间和时间变化的衡量标准。Shi等[132]利用DMSP/OLS数据和中国省级城市土地数据,评估了2000-2012年UDP(urban polycentric development)的时空变化和影响因素。

目前,深度学习 OCR 已广泛应用于卡证识别、票据单据识别、汽车相关识别(驾驶证、行驶证、车牌等)、合同文档识别等领域,这些信息对于做好贷款资料审核等风控业务十分有用。Sage等[133]提出了一种结合OCR标记的文本、空间特征和RNN的端到端表字段提取方法,能够有效提取文件流中的商业信息。Kumar等[134]使用OCR文字识别技术从票据和收据图像中提取信息,并开发了离线版应用程序,供用户及时、准确、高效的完成账单认证工作。Jang等[135]从功能和情感维度出发研究了多维OCR内容在网络营销中的重要性。Agrawal等[136]基于AI+OCR技术研发了支票单的关键组成部分挖掘模型,以完成支票验证任务。Bansal等[137]利用OCR技术提出基于属性的混合情感分类(hybrid attribute based sentiment classification ,HABSC)方法,测算了多个品牌的情感倾向。

2.2 认知智能在金融科技领域的应用1)关注度因子的加工及应用

金融市场的关注度指数可以有效地反映出公共投资者的注意力和情绪,信息被投资者关注后才能够通过投资者的交易行为传递到资产的价格表现中,因此关注度指数可以用来预测资产价格和股票价格走势。

一般的关注度指数的构建方式是通过社交媒体、搜索引擎等流量入口网站的相关关键指标的搜索量确定,Wang等[138]使用搜索引擎的数据搜索量来衡量投资者对特定行业的关注度,通过文本分析技术TextRank从特定行业的文本语料中提取关键字,然后构建描述该行业的关注度指数。文献[139-140]均以特定时长切片的谷歌搜索量构建投资者关注度指数并研究其与股票交易量与股票回报之间的关系,二者均得到了正相关的结论,即关注度指数与股票交易量和股票汇报之间均有明显的正相关关系。

国内学者Wang等[140]利用新闻数据开发了媒体环境关注指数,并通过实验证明该关注度指数与绿色产业公司股票之间存在着明显的负相关关系。张同辉等[141]选取百度网络搜索数据,构建了新的投资者关注指标并以“上证指数”和“深证成指”高频数据为研究样本,研究了不同的投资者关注水平与市场波动率之间的领先滞后关系,实验证明投资者关注不仅可以提高现有波动率预测模型的样本内拟合能力,而且在投资者高关注时期,投资者关注可以显著且稳健地提高波动模型的样本外预测能力。

2)文本情绪因子的加工及应用

互联网上有大量的股票、债券及企业本身相关的评论及研报数据。从这些文本中提炼情绪信息在金融市场研究中具有重要意义。当某些带有情绪的新闻或评论出现,特别是大量出现时,关联公司的股价可能在一定周期内发生变化。例如,杨涛等[142]的研究就发现情绪正面的新闻报道通常会对相关概念股的股价产生正向影响,而情绪负面的新闻报道则往往对股价产生负向影响。

Sun等[143]较早将自然语言处理技术应用到金融文本情绪分析中来,他们通过改进预处理方式,包括删除无用链接与数字、缩写扩展、指代消解等增强了金融领域文本情感分类器的性能。文献[144]提出了一种基于BERT双向编码器的两步优化金融新闻情绪提取模型,该模型仅依靠少量标注即可在财经新闻上实现高性能的情感分类。文献[145]也证明了在金融文本情感分析领域,基于Transformer架构的模型准确率和数据使用效率均比其他基本模型优秀。

NLP建模技术的进步在提升文本情绪识别精度的同时也催生了其在金融市场的应用,突出表现在股价走势预测上。Sousa等[146]利用标注数据对BERT模型进行微调,建立了金融新闻数据的情感分类模型,并利用模型输出对道琼斯工业指数走势进行预测。Li等[147-148]采用了类似的方案对金融新闻数据进行处理,并利用情感分析模型加工的特征构建了回归模型对股票价格进行预测,验证了舆情情绪信息对股票收益的显著影响。Yang等[139]利用BERT编码恐慌搜索词的语义表示,进一步结合自注意力深度学习模型改进恐慌关注度指数质量,并将其应用到股价走势预测上。

近些年国内利用NLP技术研究公司风险预警的文献也不断涌现。李成刚等[149]在上市公司风险预警的研究中发现加入文本情感值对预警模型的效果提升有利。姚潇等[150]建立了适用于中国金融市场的情感词典,并使用文本挖掘技术量化了管理层语调。该研究发现:积极的管理层语调能够显著降低债券信用利差。董伟[151]提出了一个集成语言模型来处理分析师报告、新闻报告和社交媒体内容信息,将文本解析成单词权重特征、话题特征、情感特征以及社交网络结构特征。该研究发现社交媒体内容对企业的金融财务欺诈预测有超前效应。

3)文本预期因子的加工及应用

文本预期因子是由文本数据中对未来趋势存在确定性判断的信息加工而来。Li等[152]在油价预测模型中尝试引入文本数据,构建油价趋势提取模型提取新闻中对未来油价的观点倾向,以捕捉影响油价波动的更直接的市场动因。这是将深度学习技术应用于原油预测的早期尝试,也是使用卷积神经网络(convolutional neural network, CNN)提取在线新闻媒体中的隐藏观点判断的初期应用。

Zhao等[153]也研究了基于网络文本挖掘的油价预测模型,论文提取了网络文本中对未来油价的4种预期信号,包含积极、中性、负面、混合4种观点。并将其应用于下游的油价预期模型。论文研究发现具有强烈预期倾向(积极、负面)的文本数据相较于其他文本数据能更好地支持油价预测。

杨兵等[154]利用年报文本数据研究了企业家市场预期对企业研发投入效应的影响机制,持乐观预期的企业家对企业研发投入具有激励效应,持悲观预期的企业家抑制企业研发投入。部慧等[155]从中国股市的股评数据提炼股评看涨看跌预期指标,并证明其对股票收益率和交易量有当期影响,开盘前非交易时段的股评预期对开盘价具有预测力,开盘后交易时段的股评预期对收盘价和日交易量具有更显著的影响。

4)基于知识图谱的金融风险预警

近些年,随着感知认知技术的进步,知识图谱在金融风险预警的研究中得到深入应用。Liu等[156]通过爬取每个公司的新闻、识别命名实体并提取相关股票之间的业务关系来构建企业知识图谱。他们门控循环单元(gated recurrent unit, GRU)模型结合相关企业知识图谱提供的信息,以预测股票的价格走势。Elnagdy等[157]建议将知识图谱与本体相结合以有效识别网络安全保险(cybersecurity insurance, CI)领域实体之间的复杂关系,同时提出了一种称为 SCIC 的网络事件分类模型,将语义网络中的所有本体连接起来以生成知识表示。此外,知识图谱可以用于处理高度凝练和随时间变化的新闻语言。DKN(deep knowledge-aware network)模型在新闻推荐中采用知识图谱表示来充分发现新闻之间潜在的知识层次联系,从而合理地为用户扩展推荐结果。文献[157-158]结合非结构化新闻文章和描述事件的结构化 Wiki 数据,构建以事件为中心的知识图谱,能够利用各种语言(包括英语、意大利语、荷兰语和西班牙语)描述世界变化并检索相关新闻文章。Ciampaglia等[159]将假新闻检测问题视为知识图谱中的关系预测任务,从事实陈述网络中挖掘异构连接模式以检查断言的真实性。

Van等[160]将知识图谱中的图表征学习引入信用卡欺诈研究领域,构建了全新的信用卡欺诈检测模型,为预测模型增加交易网络与交易结构的全新研究角度,提高了信用卡欺诈检测的效率和准确性。Shen等[161]将传统特征与知识图模型相结合来检测财务报表舞弊行为,通过量化知识图谱中的各种中心度等方法增加了新特征,提高了传统机器学习算法的检测精度。此外,多数实验结果表明,在融合了知识图谱关联特征后的规则策略能够显著提升会计欺诈识别的准确性,缩小异常账户核查的范围,使风险管理措施集中到最可疑的账户中,从而提升会计案防工作的质效[162-163]。

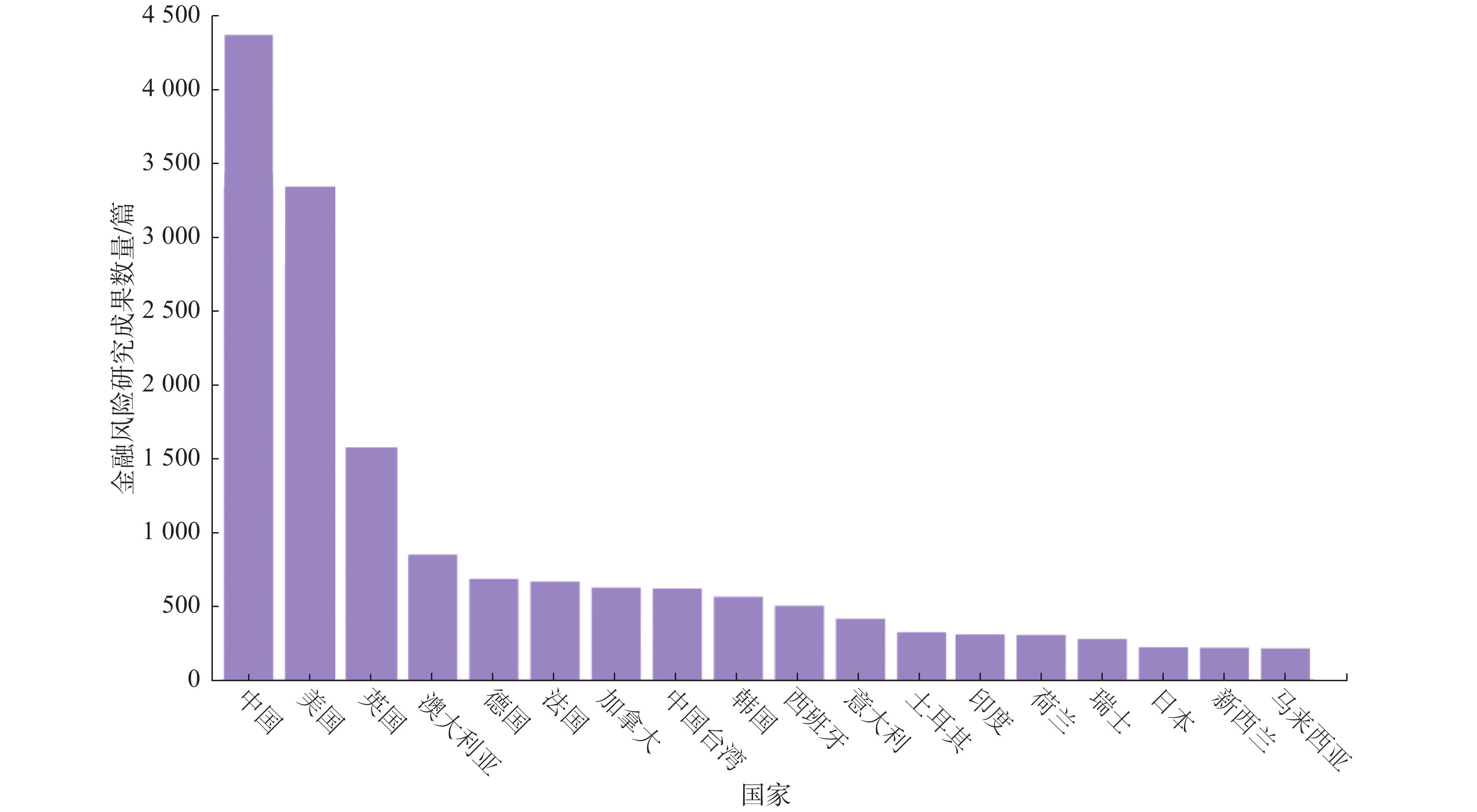

3 风险预警模型及其应用研究近10年有关股市风险、信用风险等金融风险预警的研究较多,除了企业经济领域外,在计算机、数学、工程领域也有较多的研究(图7柱状图),其中我国学者的研究世界排名第一(图8)。这一方面显示了金融风险预警这一问题在专业领域的学术价值,也体现了金融风险预警技术已经引起人工智能相关学科专家的关注。但相对一般的企业及风险预测而言,系统性等重大金融风险预警的研究相对较少(如图7树状图所示)。

|

Download:

|

| 图 7 2011-2021年金融风险预警研究成果按研究领域排名 Fig. 7 Rankings of 2011-2021 financial risk early-warning researches by research field | |

|

Download:

|

| 图 8 2011-2021年金融风险预警学术研究成果按国家排名 Fig. 8 Rankings of 2011-2021 financial risk early-warning researches by country | |

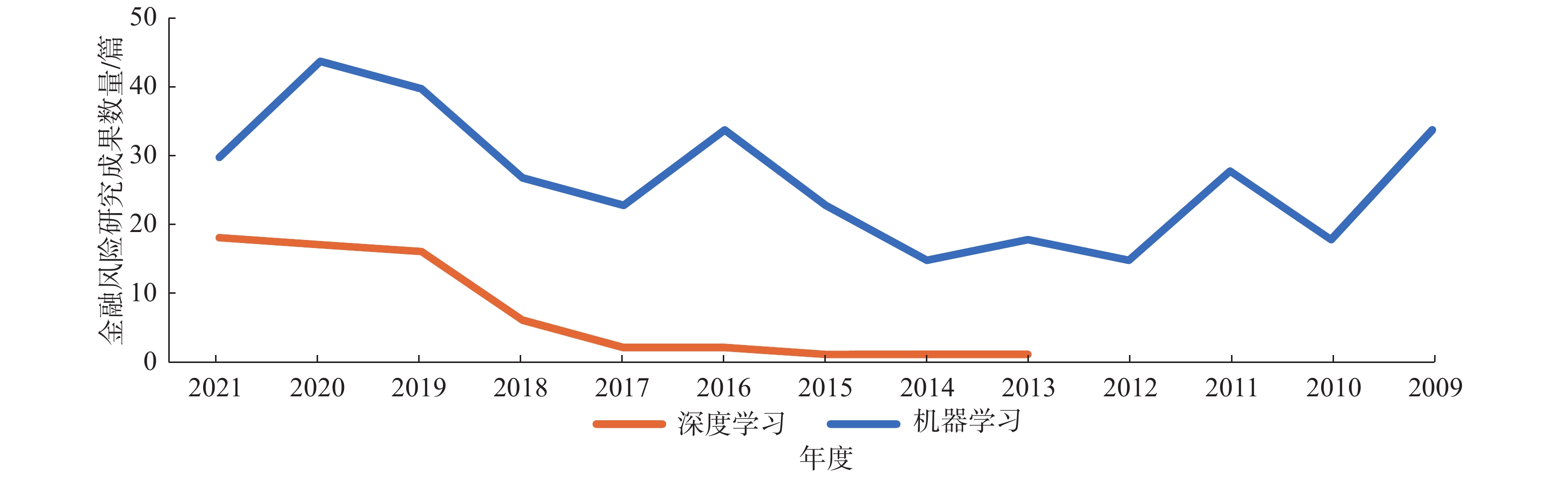

上述有关金融风险的研究中,大部分以小样本案例分析或信用评价方法为主。有监督预测模型的应用研究占比仍不高。而且,目前仍以传统机器学习模型为多,但深度学习模型占比有上升的趋势,如图9所示。下文对近几年的相关研究进行概述。

|

Download:

|

| 图 9 各类模型在金融风险预警中的研究成果 Fig. 9 Researches of different models in financial risk early-warning | |

文献[164-165]回顾了近年应用机器学习、优化等预测股票价格的研究,如神经网络类中的加强反向传播神经网络(EBPNNenhanced back propagation neural network,EBPNN)模型、使用随机时间有效方程的Elman循环神经网络(elman recurrent neural network with a stochastic time effective function,ST-ERNN)模型、模糊逻辑方法中的自适应网络模糊推理系统(adaptive-network-based fuzzy inference system,ANFIS)、进化循环模糊推理系统 (self-evolving recurrent fuzzy inference system,SERFIS)、基于遗传算法的关联规则挖掘(genetic algorithm-based association rule mining ,GA-ACR)分类模型,以及各类混合模型、混合进化模型等。文献[166]构建了一个2层结构的网络模型来刻画经济组织之间的风险传染机制,即第1层传染网络(基于权益和担保)和第2层传染网络(基于信息溢出),综合考虑了各类风险传导机制,从金融渠道和信息渠道2个维度定义了风险传导网络。文献[167]提出局部线性径向基函数神经网络(local linear radial basis function neural network,LLRBFNN) 模型,预测了某公司的金融风险。基于传统时序模型及金融工程类模型进行风险研究在一定情况下也取得了良好的表现[168-174]。

3.2 深度学习算法的应用文献[175]对深度网络模型在金融风险领域的研究进行了综述,指出LSTM应用相对较多。此外,文献[176]提出了一种使用上下文无关语法(context-free grammar,CFG)生成丰富特征并利用支持向量机(support vector machine,SVM)进行预测的模型框架。通过比对时序模型如自回归模型(auto regression,AR)、自回归移动平均模型(autoregressive integrated moving average,ARIMA)、指数平滑模型(exponential smoothing,ETS)、指数移动平均模型(exponential moving average,EMA)与基于本文特征生成方法的SVM模型以及基于标准技术指标的SVM模型预测结果,可以得到基于本文特征生成方法的SVM模型性能更佳。文献[177]利用两层 LSTM模型,基于市场信息获取的400个特征对股票市场风险进行了预测,该预测结果优于传统机器学习模型融合结果。Li等[178]利用文本数据(例如新闻)提取了投资者因子,并使用基于LSTM及深度信念网络 (deep belief nets,DBN)的预测框架对股票价格进行了预测。Vargas等[179]提出了一个RCNN模型来预测S&P500指数。该模型在传统价格指标的基础上利用word2vec从财经新闻标题中提取了7个技术指标。Zhang等[180]使用带有LSTM+CNN以交易软件提供的公开可用指数为输入对金融市场下行风险进行了预测。该模型在训练过程中实施了生成对抗网络(generative adversarial network,GAN)技术,同时避免了复杂的金融理论研究和困难的技术分析,为非金融专业的普通交易者提供了便利。类似基于LSTM、RNN等深度网络算法对股票价格或金融风险进行的研究可参见文献[181-184]。

4 结束语感知认知技术本身面临一些困难与瓶颈。首先,大量标注让研究人员在简单却繁杂的标注任务上耗费了大量的时间。其次,各类算法泛化应用效果有降低甚至失效风险。不少基于深度神经网络的算法在基准数据集上的表现很好,但是在数据集之外的真实世界中则表现平平,这使得将算法应用到现实场景的过程十分缓慢。其三则是跨场景迁移面临障碍,深度神经网络对于场景的变化十分敏感。此外,现有文本处理技术对文本信息进行深度理解和逻辑推理的能力较差。

计算机视觉与认知神经科学、应用数学和统计学等学科的交叉,与各类软硬件的融合搭配,未来将迎来更为旺盛的发展。高动态复杂场景下的视觉场景理解、小样本目标识别、复杂语义行为理解等方向也会是未来发展的重要组成部分。本文挖掘在未来的发展中可能会存在如下发展趋势:1) 脑科学等领域的研究突破可能会创造出更强大的语义理解模型,以更好地分析长文本、多歧义、深层逻辑等复杂文本数据;2) 由于金融领域是需要较强解释性的应用领域,而传统的深度模型大都处于一个黑盒子难以解释的状态,深度模型在金融领域的可解释性也将是未来一个重要的研究课题。

可以预期,随着图像处理技术、自然语言处理技术的发展,未来能从图像、文本中提取的基础信息将更加精准和多样。然而,为了将这些基础信息更好地用于金融风险预警建模,在领域知识的指引下巧妙使用图像和自然语言处理技术将是未来十分重要的一个发展方向。因为并非简单使用通用感知认知技术就可以从海量异构数据源中挖掘出可用于金融风险预警的有效因子。例如,通过研究股市、债券、信贷风险规律,反向推导至底层基础信息需求,才指引我们从图像中挖掘农作物面积、成灾数据和原油运输数据,从新闻、研报、评论中抽取与股价、油价、债券违约、企业风险预期有关的文本信息,并据此完善相关知识图谱,最终才为金融风险预警模型的构建提供了必要的因子与知识。

最后,现有研究主要关注企业单点风险,但风险传导是更为关键的问题。风险传导路径的推演不仅仅是一个预测问题,其本质更是一个推理问题。虽然人工智能技术的进步推动了机器视觉技术、自然语言处理技术的突破性发展。但是其在复杂决策领域的表现仍不理想,例如在逻辑关系推理、投资决策、风险预警等领域,基于人工智能的推理方法明显落后于专家推理。总体来讲,这些领域存在映射关系复杂、决策空间巨大、可学习样本/数据缺稀、规律/数据分布时变性强的特点。为了解决这些问题,要通过人类知识与算法的融合实现更好的推理,这将是未来的一个重要研究方向。本文认为强化学习算法为实现这一思想提供了良好的技术载体,未来应该研究以专家知识为指导的强化学习算法,以期达到“青出于蓝而胜于蓝”的效果。

| [1] |

CHEN Jianwei, LIN Wanju, CHENG Huijun, et al. A smartphone-based application for scale pest detection using multiple-object detection methods[J]. Electronics, 2021, 10(4): 372.

( 0) 0)

|

| [2] |

GARCÍA D. Sentiment during recessions[J]. The journal of finance, 2013, 68(3): 1267–1300.

( 0) 0)

|

| [3] |

KUMAR P, SAJJAD H, JOSHI P K, et al. Modeling the luminous intensity of Beijing, China using DMSP-OLS night-time lights series data for estimating population density[J]. Physics and chemistry of the earth, parts A/B/C, 2019, 109: 31–39.

( 0) 0)

|

| [4] |

ZHONG Yang, LIN Aiwei, ZHOU Zhigao, et al. Spatial pattern evolution and optimization of urban system in the Yangtze River economic belt, China, based on DMSP-OLS night light data[J]. Sustainability, 2018, 10(10): 3782.

( 0) 0)

|

| [5] |

KIANPISHEH M, LI F N, TRUONG K N. Face recognition assistant for people with visual impairments[J]. Proceedings of the ACM on interactive, mobile, wearable and ubiquitous technologies, 2019, 3(3): 90.

( 0) 0)

|

| [6] |

BAKER S R, BLOOM N, DAVIS S J. Measuring economic policy uncertainty[J]. The quarterly journal of economics, 2016, 131(4): 1593–1636.

( 0) 0)

|

| [7] |

SHAPIRO A H, SUDHOF M, WILSON D, et al. Measuring news sentiment[J]. Fereral reserve bank of San Francisco working paper, 2017: 1–49

( 0) 0)

|

| [8] |

THORSRUD L A. Words are the new numbers: a newsy coincident index of the business cycle[J]. Journal of business & economic statistics, 2020, 38(2): 393–409.

( 0) 0)

|

| [9] |

HILLERT A, JACOBS H, MÜLLER S. Media makes momentum[J]. The review of financial studies, 2014, 27(12): 3467–3501.

( 0) 0)

|

| [10] |

BEN-REPHAEL A, DA Zhi, ISRAELSEN R D. It depends on where you search: institutional investor attention and underreaction to news[J]. The review of financial studies, 2017, 30(9): 3009–3047.

( 0) 0)

|

| [11] |

TETLOCK P C. Giving content to investor sentiment: the role of media in the stock market[J]. The journal of finance, 2007, 62(3): 1139–1168.

( 0) 0)

|

| [12] |

HILLERT A, JACOBS H, MÜLLER S. Journalist disagreement[J]. Journal of financial markets, 2018, 41: 57–76.

( 0) 0)

|

| [13] |

HOBERG G, PHILLIPS G M. Text-based industry momentum[J]. Journal of financial and quantitative analysis, 2018, 53(6): 2355–2388.

( 0) 0)

|

| [14] |

LI Feng. The information content of forward-looking statements in corporate filings-a naïve Bayesian machine learning approach[J]. Journal of accounting research, 2010, 48(5): 1049–1102.

( 0) 0)

|

| [15] |

LOUGHRAN T, MCDONALD B. When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks[J]. The journal of finance, 2011, 66(1): 35–65.

( 0) 0)

|

| [16] |

JEGADEESH N, WU Di. Word power: a new approach for content analysis[J]. Journal of financial economics, 2013, 110(3): 712–729.

( 0) 0)

|

| [17] |

LI Feng. Annual report readability, current earnings, and earnings persistence[J]. Journal of accounting and economics, 2008, 45(2/3): 221–247.

( 0) 0)

|

| [18] |

LOUGHRAN T, MCDONALD B. Measuring readability in financial disclosures[J]. The journal of finance, 2014, 69(4): 1643–1671.

( 0) 0)

|

| [19] |

ANTWEILER W, FRANK M Z. Is all that talk just noise? the information content of internet stock message boards[J]. The journal of finance, 2004, 59(3): 1259–1294.

( 0) 0)

|

| [20] |

KIM S H, KIM D. Investor sentiment from internet message postings and the predictability of stock returns[J]. Journal of economic behavior & organization, 2014, 107: 708–729.

( 0) 0)

|

| [21] |

TSUKIOKA Y, YANAGI J, TAKADA T. Investor sentiment extracted from internet stock message boards and IPO puzzles[J]. International review of economics & finance, 2018, 56: 205–217.

( 0) 0)

|

| [22] |

HARIHARAN B, ARBELÁEZ P, GIRSHICK R, et al. Simultaneous detection and segmentation[C]//Proceedings of the 13th European Conference on Computer Vision. Zurich, Switzerland, 2014: 297–312.

( 0) 0)

|

| [23] |

HARIHARAN B, ARBELÁEZ P, GIRSHICK R, et al. Hypercolumns for object segmentation and fine-grained localization[C]//Proceedings of 2015 IEEE Conference on Computer Vision and Pattern Recognition. Boston, USA, 2015: 447–456.

( 0) 0)

|

| [24] |

DAI Jifeng, HE Kaiming, SUN Jian. Instance-aware semantic segmentation via multi-task network cascades[C]//Proceedings of 2016 IEEE Conference on Computer Vision and Pattern Recognition. Las Vegas, USA, 2016: 3150–3158.

( 0) 0)

|

| [25] |

HE Kaiming, GKIOXARI G, DOLLÁR P, et al. Mask R-CNN[C]//Proceedings of 2017 IEEE International Conference on Computer Vision. Venice, Italy, 2017: 2980–2988.

( 0) 0)

|

| [26] |

ANDREJ KARPATHY, LI Feifei. Deep visual-semantic alignments for generating image descriptions[C]// Proceedings of the IEEE Conference on Computer Vision and Pattern Recognition (CVPR). Boston, USA, 2015: 3128–3137.

( 0) 0)

|

| [27] |

XU K, BA J L, KIROS R, et al. Show, attend and tell: neural image caption generation with visual attention[C]//Proceedings of the 32nd International Conference on Machine Learning. Lille, France, 2015: 2048–2057.

( 0) 0)

|

| [28] |

WU Qi, SHEN Chunhua, WANG Peng, et al. Image captioning and visual question answering based on attributes and external knowledge[J]. IEEE transactions on pattern analysis and machine intelligence, 2018, 40(6): 1367–1381.

( 0) 0)

|

| [29] |

KANG Kai, LI Hongsheng, YAN Junjie, et al. T-CNN: tubelets with convolutional neural networks for object detection from videos[J]. IEEE transactions on circuits and systems for video technology, 2018, 28(10): 2896–2907.

( 0) 0)

|

| [30] |

VIOLA P, JONES M. Rapid object detection using a boosted cascade of simple features[C]//Proceedings of the 2001 IEEE Computer Society Conference on Computer Vision and Pattern Recognition. Kauai, USA, 2001:511–518.

( 0) 0)

|

| [31] |

DALAL N, TRIGGS B. Histograms of oriented gradients for human detection[C]//Proceedings of 2005 IEEE Computer Society Conference on Computer Vision and Pattern Recognition. San Diego, USA, 2005: 886–893.

( 0) 0)

|

| [32] |

FELZENSZWALB P, MCALLESTER D, RAMANAN D. A discriminatively trained, multiscale, deformable part model[C]//Proceedings of 2008 IEEE Conference on Computer Vision and Pattern Recognition. Anchorage, USA, 2008: 1–8.

( 0) 0)

|

| [33] |

GIRSHICK R, DONAHUE J, DARRELL T, et al. Rich feature hierarchies for accurate object detection and semantic segmentation[C]//Proceedings of 2014 IEEE Conference on Computer Vision and Pattern Recognition. Columbus, USA, 2014: 580–587.

( 0) 0)

|

| [34] |

HE Kaiming, ZHANG Xiangyu, REN Shaoqing, et al. Spatial pyramid pooling in deep convolutional networks for visual recognition[J]. IEEE transactions on pattern analysis and machine intelligence, 2015, 37(9): 1904–1916.

( 0) 0)

|

| [35] |

GIRSHICK R. Fast R-CNN[C]//Proceedings of 2015 IEEE International Conference on Computer Vision. Santiago, Chile, 2015: 1440–1448.

( 0) 0)

|

| [36] |

REN Shaoqing, HE Kaiming, GIRSHICK R, et al. Faster R-CNN: towards real-time object detection with region proposal networks[C]//Proceedings of the Advances in Neural Information Processing Systems 28 (NIPS 2015). Montreal, Quebec, Canada, 2015:91–99.

( 0) 0)

|

| [37] |

HE Kaiming, ZHANG Xiangyu, REN Shaoqing, et al. Deep residual learning for image recognition[C]//Proceedings of 2016 IEEE Conference on Computer Vision and Pattern Recognition. Las Vegas, USA, 2016: 770–778,

( 0) 0)

|

| [38] |

KONG Tao, YAO Anbang, CHEN Yurong, et al. HyperNet: towards accurate region proposal generation and joint object detection[C]//Proceedings of 2016 IEEE Conference on Computer Vision and Pattern Recognition. Las Vegas, USA, 2016: 845–853.

( 0) 0)

|

| [39] |

DAI Jifeng, LI Yi, HE Kaiming, et al. R-FCN: object detection via region-based fully convolutional networks[C]//Proceedings of the 30th International Conference on Neural Information Processing Systems. Barcelona, Spain, 2016: 379–387.

( 0) 0)

|

| [40] |

LIN T Y, DOLLÁR P, GIRSHICK R, et al. Feature pyramid networks for object detection[C]//Proceedings of 2017 IEEE Conference on Computer Vision and Pattern Recognition. Honolulu, USA, 2017: 936–944.

( 0) 0)

|

| [41] |

BAEK Y, LEE B, HAN D, et al. Character region awareness for text detection[C]//Proceedings of 2019 IEEE/CVF Conference on Computer Vision and Pattern Recognition. Long Beach, USA, 2019: 9357–9366.

( 0) 0)

|

| [42] |

REDMON J, DIVVALA S, GIRSHICK R, et al. You only look once: unified, real-time object detection[C]//Proceedings of 2016 IEEE Conference on Computer Vision and Pattern Recognition. Las Vegas, USA, 2016: 779–788.

( 0) 0)

|

| [43] |

REDMON J, FARHADI A. YOLO9000: better, faster, stronger[C]//Proceedings of 2017 IEEE Conference on Computer Vision and Pattern Recognition. Honolulu, USA, 2017: 6517–6525.

( 0) 0)

|

| [44] |

REDMON J, FARHADI A. YOLOv3: an incremental improvement[EB/OL]. (2018-04-08).https://arxiv.org/abs/1804.02767.

( 0) 0)

|

| [45] |

BOCHKOVSKIY A, WANG C Y, LIAO H Y M. YOLOv4: optimal speed and accuracy of object detection[EB/OL]. (2020-04-23).https://arxiv.org/abs/2004.10934.

( 0) 0)

|

| [46] |

SHAFIEE M J, CHYWL B, LI F, Wong Aet al. Fast YOLO: a fast you only look once system for real-time embedded object detection in video[EB/OL].(2017-09-18). https://arxiv.org/abs/1709.05943.

( 0) 0)

|

| [47] |

SIMON M, MILZ S, AMENDE K, et al. Complexer-YOLO: real-time 3D object detection and tracking on semantic point clouds[C]// 2019 IEEE/CVF Conference on Computer Vision and Pattern Recognition Workshops (CVPRW). Long Beach California, USA, 2019:1190–1199.

( 0) 0)

|

| [48] |

HURTIK P, MOLEK V, HULA J, et al. Poly-YOLO: higher speed, more precise detection and instance segmentation for YOLOv3[J]. (2020-05-27). https://arxiv.org/abs/2005.13243.

( 0) 0)

|

| [49] |

LONG Xiang, DENG Kaipeng, WANG Guanzhong, et al. PP-YOLO: an effective and efficient implementation of object detector[J]. (2020-07-23). https://arxiv.org/abs/2007.12099.

( 0) 0)

|

| [50] |

LIU Wei, ANGUELOV D, ERHAN D, et al. SSD: single shot MultiBox detector[C]//Proceedings of the 14th European Conference on Computer Vision. Amsterdam, The Netherlands, 2016: 21–37.

( 0) 0)

|

| [51] |

FU Chengyang, LIU Wei, RANGA A, et al. DSSD: Deconvolutional single shot detector[J]. arXiv preprint arXiv:1701.06659. (2017-01-23). https://arxiv.org/abs/1701.06659.

( 0) 0)

|

| [52] |

SHEN Zhiqiang, LIU Zhuang, LI Jianguo, et al. DSOD: learning deeply supervised object detectors from scratch[C]//Proceedings of 2017 IEEE International Conference on Computer Vision. Venice, Italy, 2017: 1937–1945.

( 0) 0)

|

| [53] |

JEONG J, PARK H, KWAK N. Enhancement of SSD by concatenating feature maps for object detection[J]. (2017-05-26). https://arxiv.org/abs/1705.09587.

( 0) 0)

|

| [54] |

ZHAO Qijie, SHENG Tao, WANG Yongtao, et al. M2Det: a single-shot object detector based on multi-level feature pyramid network[J]. Proceedings of the AAAI conference on artificial intelligence, 2019, 33(1): 9529–9266.

( 0) 0)

|

| [55] |

ZHANG Shifeng, WEN Longyin, BIAN Xiao, et al. Single-shot refinement neural network for object detection[C]//Proceedings of 2018 IEEE/CVF Conference on Computer Vision and Pattern Recognition. Salt Lake City, USA, 2018: 4203–4212.

( 0) 0)

|

| [56] |

ZHAI Sheping, SHANG Dingrong, WANG Shuhuan, et al. DF-SSD: an improved SSD object detection algorithm based on DenseNet and feature fusion[J]. IEEE access, 2020, 8: 24344–24357.

( 0) 0)

|

| [57] |

ZHOU Shuren, QIU Jia. Enhanced SSD with interactive multi-scale attention features for object detection[J]. Multimedia tools and applications, 2021, 80(8): 11539–11556.

( 0) 0)

|

| [58] |

PAPAGEORGIOU C, POGGIO T. A trainable system for object detection[J]. International journal of computer vision, 2000, 38(1): 15–33.

( 0) 0)

|

| [59] |

LECUN Y, BOTTOU L, BENGIO Y, et al. Gradient-based learning applied to document recognition[J]. Proceedings of the IEEE, 1998, 86(11): 2278–2324.

( 0) 0)

|

| [60] |

KRIZHEVSKY A, SUTSKEVER I, HINTON G E. ImageNet classification with deep convolutional neural networks[C]//Proceedings of the 25th International Conference on Neural Information Processing Systems. Lake Tahoe, Nevada, 2012:1–9.

( 0) 0)

|

| [61] |

SIMONYAN K, ZISSERMAN A. Very deep convolutional networks for large-scale image recognition[C]//Proceedings of the 3rd International Conference on Learning Representations. San Diego, USA, 2015:1–14.

( 0) 0)

|

| [62] |

C. SZEGEDY C, LIU Wei, JIA Yangqing, et al. Going deeper with convolutions[C]//Proceedings of 2015 IEEE Conference on Computer Vision and Pattern Recognition. Boston, USA, 2015: 1–9.

( 0) 0)

|

| [63] |

SZEGEDY C, VANHOUCKE V, IOFFE S, et al. Rethinking the inception architecture for computer vision[C]//Proceedings of 2016 IEEE Conference on Computer Vision and Pattern Recognition. Las Vegas, USA, 2016: 2818–2826.

( 0) 0)

|

| [64] |

SZEGEDY C, IOFFE S, VANHOUCKE V, et al. Inception-v4, Inception-ResNet and the impact of residual connections on learning[C]//Proceedings of the 31st AAAI Conference on Artificial Intelligence. San Francisco, California, USA, 2017:1–12.

( 0) 0)

|

| [65] |

CHEN Wanpei, QIAO Yanting, LI Yujie. Inception-SSD: an improved single shot detector for vehicle detection[J]. Journal of ambient intelligence and humanized computing, 2020,5:1–7.

( 0) 0)

|

| [66] |

ALOM M Z, HASAN M, YAKOPCIC C, et al. Inception recurrent convolutional neural network for object recognition[J]. Machine vision and applications, 2021, 32(1): 28.

( 0) 0)

|

| [67] |

TIAN Zhi, HUANG Weilin, HE Tong, et al. Detecting text in natural image with connectionist text proposal network[C]//Proceedings of the 14th European Conference on Computer Vision. Amsterdam, The Netherlands, 2016:1–17.

( 0) 0)

|

| [68] |

LIAO Minghui, WAN Zhaoyi, YAO Cong, et al. Real-time scene text detection with differentiable binarization[J]. Proceedings of the AAAI conference on artificial intelligence, 2020, 34(7): 11474–11481.

( 0) 0)

|

| [69] |

ELAGOUNI K, GARCIA C, MAMALET F, et al. Text recognition in videos using a recurrent connectionist approach[C]//Proceedings of the 22th International Conference on Artificial Neural Networks. Lausanne, Switzerland, 2012: 172–179.

( 0) 0)

|

| [70] |

CAO Chunshui, LIU Xianming, YANG Yi, et al. Look and think twice: capturing top-down visual attention with feedback convolutional neural networks[C]//Proceedings of 2015 IEEE International Conference on Computer Vision. Santiago, Chile, 2015: 2956–2964.

( 0) 0)

|

| [71] |

WOJNA Z, GORBAN A N, LEE D S, et al. Attention-based extraction of structured information from street view imagery[C]//Proceedings of the 14th IAPR International Conference on Document Analysis and Recognition. Kyoto, Japan, 2017: 844–850.

( 0) 0)

|

| [72] |

SHI Baoguang, BAI Xiang, YAO Cong. An end-to-end trainable neural network for image-based sequence recognition and its application to scene text recognition[J]. IEEE transactions on pattern analysis and machine intelligence, 2017, 39(11): 2298–2304.

( 0) 0)

|

| [73] |

XUE Wenyuan, LI Qingyuong, ZHANG Zhen, et al. Table analysis and information extraction for medical laboratory reports[C]//Proceedings of the 16th Intl Conf on Dependable, Autonomic and Secure Computing, 16th Intl Conf on Pervasive Intelligence and Computing, 4th Intl Conf on Big Data Intelligence and Computing and Cyber Science and Technology Congress (DASC/PiCom/DataCom/CyberSciTech). Athens, Greece, 2018: 193–199.

( 0) 0)

|

| [74] |

MARTÍNEK J, LENC L, KRÁL P. Building an efficient OCR system for historical documents with little training data[J]. Neural computing and applications, 2020, 32(3): 17209–17227.

( 0) 0)

|

| [75] |

HUANG Jing, PANG Guan, KOVVURI R, et al. A multiplexed network for End-to-End, multilingual OCR[C]//Proceedings of the IEEE/CVF Conference on Computer Vision and Pattern Recognition. 2021: 4547–4557.

( 0) 0)

|

| [76] |

SHOTTON J, JOHNSON M, CIPOLLA R. Semantic texton forests for image categorization and segmentation[C]//Proceedings of 2008 IEEE Conference on Computer Vision and Pattern Recognition. Anchorage, USA, 2008: 1–8.

( 0) 0)

|

| [77] |

SHOTTON J, FITZGIBBON A, COOK M, et al. Real-time human pose recognition in parts from single depth images[C]//Proceedings of 2011 IEEE Conference on Computer Vision and Pattern Recognition. Colorado Springs, USA, 2011: 1297–1304.

( 0) 0)

|

| [78] |

CIRESAN D C, GIUSTI A, GAMBARDELLA L, et al. Deep neural networks segment neuronal membranes in electron microscopy images[C]//Proceedings of the 25th International Conference on Neural Information Processing Systems. Lake Tahoe, Nevada, 2012:2852–2860.

( 0) 0)

|

| [79] |

LONG J, SHELHAMER E, DARRELL T. Fully convolutional networks for semantic segmentation[C]//Proceedings of 2015 IEEE Conference on Computer Vision and Pattern Recognition. Boston, USA, 2015: 3431–3440.

( 0) 0)

|

| [80] |

RONNEBERGER O, FISCHER P, BROX T. U-Net: convolutional networks for biomedical image segmentation[C]//Proceedings of the 18th International Conference on Medical Image Computing and Computer-Assisted Intervention. Munich, Germany, 2015: 234–241.

( 0) 0)

|

| [81] |

YU F, KOLTUN V. Multi-scale context aggregation by dilated convolutions[C]//Proceedings of the 4th International Conference on Learning Representations. San Juan, Puerto Rico, 2016:1–13.

( 0) 0)

|

| [82] |

KRÄHENBÜHL P, KOLTUN V. Efficient inference in fully connected CRFs with Gaussian edge potentials[C]//Proceedings of the 24th International Conference on Neural Information Processing Systems. Granada, Spain, 2011:1–9.

( 0) 0)

|

| [83] |

CHEN L C, PAPANDREOU G, KOKKINOS I, et al. Semantic image segmentation with deep convolutional nets and fully connected CRFs[J]. (2014-12-22). https://arxiv.org/abs/1412.7062.

( 0) 0)

|

| [84] |

CHEN L C, PAPANDREOU G, KOKKINOS I, et al. DeepLab: Semantic image segmentation with deep convolutional nets, atrous convolution, and fully connected CRFs[J]. IEEE transactions on pattern analysis and machine intelligence, 2018, 40(4): 834–848.

( 0) 0)

|

| [85] |

CHEN L C, PAPANDREOU G, SCHROFF F, et al. Rethinking atrous convolution for semantic image segmentation[J]. (2017-01-17). https://arxiv.org/abs/1706.05587.

( 0) 0)

|

| [86] |

CHEN L C, ZHU Yukun, PAPANDREOU G, et al. Encoder-decoder with atrous separable convolution for semantic image segmentation[C]//Proceedings of the 15th European Conference on Computer Vision. Munich, Germany, 2018: 833–851.

( 0) 0)

|

| [87] |

SUN Guolei, WANG Wenguan, DAI Jifeng, et al. Mining cross-image semantics for weakly supervised semantic segmentation[C]//Proceedings of the 16th European Conference on Computer Vision. Glasgow, UK, 2020: 347–365.

( 0) 0)

|

| [88] |

ARASLANOV N, ROTH S. Single-stage semantic segmentation from image labels[C]//Proceedings of 2020 IEEE/CVF Conference on Computer Vision and Pattern Recognition. Seattle, USA, 2020: 4252–4261.

( 0) 0)

|

| [89] |

BOLME D S, BEVERIDGE J R, DRAPER B A, et al. Visual object tracking using adaptive correlation filters[C]//Proceedings of 2010 IEEE Computer Society Conference on Computer Vision and Pattern Recognition. San Francisco, USA, 2010: 2544–2550.

( 0) 0)

|

| [90] |

HENRIQUES J F, CASEIRO R, MARTINS P, et al. Exploiting the circulant structure of tracking-by-detection with kernels[C]//Proceedings of the 12th European Conference on Computer Vision. Florence, Italy, 2012: 702–715.

( 0) 0)

|

| [91] |

GALOOGAHI H K, FAGG A, LUCEY S. Learning background-aware correlation filters for visual tracking[C]//Proceedings of 2017 IEEE International Conference on Computer Vision. Venice, Italy, 2017: 1144–1152.

( 0) 0)

|

| [92] |

LI Yang, ZHU Jianke. A scale adaptive kernel correlation filter tracker with feature integration[C]//Proceedings of the European Conference on Computer Vision. Zurich, Switzerland, 2014: 254–265.

( 0) 0)

|

| [93] |

DANELLJAN M, HÄGER G, KHAN F S, et al. Convolutional features for correlation filter based visual tracking[C]//Proceedings of 2015 IEEE International Conference on Computer Vision Workshop. Santiago, Chile, 2015: 621–629.

( 0) 0)

|

| [94] |

VOIGTLAENDER P, LUITEN J, TORR P H S, et al. Siam R-CNN: visual tracking by re-detection[C]//Proceedings of 2020 IEEE/CVF Conference on Computer Vision and Pattern Recognition. Seattle, USA, 2020: 6577–6587.

( 0) 0)

|

| [95] |

FU Zhihong, LIU Qingjie, FU Zehua, et al. STMTrack: template-free visual tracking with space-time memory networks[C]//Proceedings of the IEEE/CVF Conference on Computer Vision and Pattern Recognition. 2021: 13774–13783.

( 0) 0)

|

| [96] |

MIKOLOV T, CHEN Kai, CORRADO G, et al. Efficient estimation of word representations in vector space[C]//Proceedings of the 1st International Conference on Learning Representations. Scottsdale, Arizona, USA, 2013:1–9.

( 0) 0)

|

| [97] |

JOULIN A, GRAVE E, BOJANOWSKI P, et al. Bag of tricks for efficient text classification[C]//Proceedings of the 15th Conference of the European Chapter of the Association for Computational Linguistics. Valencia, Spain, 2017:1–5.

( 0) 0)

|

| [98] |

PENNINGTON J, SOCHER R, MANNING C D. GloVe: global vectors for word representation[C]//Proceedings of 2014 Conference on Empirical Methods in Natural Language Processing. Doha, Qatar, 2014:1532–1543.

( 0) 0)

|

| [99] |

PETERS M E, NEUMANN M, IYYER M, et al. Deep contextualized word representations[C]//Proceedings of the 2018 Conference of the North American Chapter of the Association for Computational Linguistics: Human Language Technologies. New Orleans, Louisiana, 2018:1–15.

( 0) 0)

|

| [100] |

HOCHREITER S, SCHMIDHUBER J. Long short-term memory[J]. Neural computation, 1997, 9(8): 1735–1780.

( 0) 0)

|

| [101] |

CHUNG J, GULCEHRE C, CHO K, et al. Empirical evaluation of gated recurrent neural networks on sequence modeling[J]. (2014-12-11). https://arXiv:1412.3555, 2014.

( 0) 0)

|

| [102] |

T DDESELL T, ELSAID A, ORORBIA A G. An empirical exploration of deep recurrent connections using neuro-evolution[C]//Proceedings of the 23rd International Conference on the Applications of Evolutionary Computation (Part of EvoStar). Seville, Spain, 2020:1–16.

( 0) 0)

|

| [103] |

VASWANI A, SHAZEER N, PARMAR N, et al. Attention is all you need[C]//Proceedings of the 31st International Conference on Neural Information Processing Systems. Long Beach, California, USA, 2017: 6000–6010.

( 0) 0)

|

| [104] |

BAHDANAU D, CHO K, BENGIO Y. Neural machine translation by jointly learning to align and translate[C]//Proceedings of the 3rd International Conference on Learning Representations. San Diego, USA, 2015:1–15.

( 0) 0)

|

| [105] |

HU Dichao. An introductory survey on attention mechanisms in NLP problems[C]//Proceedings of SAI Intelligent Systems Conference. Cham, Germany, 2020:1–9.

( 0) 0)

|

| [106] |

DEVLIN J, CHANG Mingwei, LEE K, et al. BERT: pre-training of deep bidirectional transformers for language understanding[J]. (2019-10-11). https://arXiv:1810.04805, 2019.

( 0) 0)

|

| [107] |

TAYLOR W L. Cloze procedure: a new tool for measuring readability[J]. Journalism & mass communication quarterly, 1953, 30(4): 415–433.

( 0) 0)

|

| [108] |

RADFORD A, NARASIMHAN K, SALIMANS T, et al. Improving language understanding by generative pre-training[J]. Computation and language, 2017, 4(6):212–220.

( 0) 0)

|

| [109] |

LIU Yinhan, OTT M, GOYAL N, et al. RoBERTa: a robustly optimized BERT pretraining approach[J]. (2019-07-26). https://arXiv:1907.11692, 2019.

( 0) 0)

|

| [110] |

YANG Zhilin, DAI Zihang, YANG Yiming, et al. XLNet: generalized autoregressive pretraining for language understanding[C]//Proceedings of the 33rd International Conference on Neural Information Processing Systems. Red Hook, USA, 2019:1–11.

( 0) 0)

|

| [111] |

SONG Kaitao, TAN Xu, QIN Tao, et al. MASS: masked sequence to sequence pre-training for language generation[J]. (2019-05-07). https://arXiv:1905.02450, 2019.

( 0) 0)

|

| [112] |

RAFFEL C, SHAZEER N, ROBERTS A, et al. Exploring the limits of transfer learning with a unified text-to-text transformer[J]. (2019-10-23). https://arXiv:1910.10683, 2020.

( 0) 0)

|

| [113] |

SUN Yu, WANG Shuohuan, LI Yukun, et al. ERNIE: enhanced representation through knowledge integration[J]. (2019-04-19). https://arXiv:1904.09223, 2019.

( 0) 0)

|

| [114] |

ZAHEER M, GURUGANESH G, DUBEY A, et al. Big bird: transformers for longer sequences[J]. (2020-07-28). https://arXiv:2007.14062, 2021.

( 0) 0)

|

| [115] |

JIANG Zihang, YU Weihao, ZHOU Daquan, et al. ConvBERT: improving BERT with span-based dynamic convolution[J]. (2020-08-06). https://arXiv:2008.02496, 2021.

( 0) 0)

|

| [116] |

BROWN T B, MANN B, RYDER N, et al. Language models are few-shot learners[J]. (2020-05-28). https://arXiv:2005.14165, 2020.

( 0) 0)

|

| [117] |

Yang B, Liao Y. Research on enterprise risk knowledge graph based on multi-source data fusion[J]. Neural Computing and Applications, 2021: 1–14.

( 0) 0)

|

| [118] |

BIROGUL S, TEMÜR G, KSE U. YOLO object recognition algorithm and “buy-sell decision” model over 2D candlestick charts[J]. IEEE access, 2020, 8: 91894–91915.

( 0) 0)

|

| [119] |

WANG Yanwei, LIU Huiqing, GUO Mingzhe, et al. Image recognition model based on deep learning for remaining oil recognition from visualization experiment[J]. Fuel, 2021, 291: 120216.

( 0) 0)

|

| [120] |

HU Changbo, LI Qun, ZHANG Zhen, et al. A multimodal fusion framework for brand recognition from product image and context[C]//Proceedings of 2020 IEEE International Conference on Multimedia & Expo Workshops. London, UK, 2020:1–4.

( 0) 0)

|

| [121] |

JIANG Xiaoheng, ZHANG Li, XU Mingliang, et al. Attention scaling for crowd counting[C]//Proceedings of 2020 IEEE/CVF Conference on Computer Vision and Pattern Recognition. Seattle, USA, 2020: 4705–4714.

( 0) 0)

|

| [122] |

ZHANG Zehui, SUN Xuehong. Crowd density estimation based on convolutional neural network[C]//Proceedings of the 20th International Conference on Communication Technology. Nanning, China, 2020: 1509–1513.

( 0) 0)

|

| [123] |

LIU Weizhe, SALZMANN M, FUA P. Estimating people flows to better count them in crowded scenes[C]//Proceedings of the 16th European Conference on Computer Vision. Glasgow, UK, 2020: 723–740.

( 0) 0)

|

| [124] |

BELAN P, VANIN A S, NETZER E. Computer vision system for public illumination management[J]. International journal of computer applications, 2020, 175(31): 45–50.

( 0) 0)

|

| [125] |

YANG Si, ZHENG Lihua, HE Peng, et al. High-throughput soybean seeds phenotyping with convolutional neural networks and transfer learning[J]. Plant methods, 2021, 17(1): 50.

( 0) 0)

|

| [126] |

SAFONOVA A, GUIRADO E, MAGLINETS Y, et al. Olive tree biovolume from UAV multi-resolution image segmentation with mask R-CNN[J]. Sensors, 2021, 21(5): 1617.

( 0) 0)

|

| [127] |

ZHANG Keke, WU Qiufeng, CHEN Yiping. Detecting soybean leaf disease from synthetic image using multi-feature fusion faster R-CNN[J]. Computers and electronics in agriculture, 2021, 183: 106064.

( 0) 0)

|

| [128] |

GRIFFITHS D, BOEHM J. Improving public data for building segmentation from Convolutional Neural Networks (CNNs) for fused airborne lidar and image data using active contours[J]. ISPRS journal of photogrammetry and remote sensing, 2019, 154: 70–83.

( 0) 0)

|

| [129] |

TIEDE D, SCHWENDEMANN G, ALOBAIDI A, et al. Mask R-CNN-based building extraction from VHR satellite data in operational humanitarian action: an example related to Covid-19 response in Khartoum, Sudan[J]. Transactions in GIS, 2021, 25(3): 1213–1227.

( 0) 0)

|

| [130] |

YU Sisi, ZHANG Zengxiang, LIU Fang. Monitoring population evolution in china using time-series DMSP/OLS nightlight imagery[J]. Remote sensing, 2018, 10(2): 194.

( 0) 0)

|

| [131] |

ZHANG Qingling, SETO K C. Mapping urbanization dynamics at regional and global scales using multi-temporal DMSP/OLS nighttime light data[J]. Remote sensing of environment, 2011, 115(9): 2320–2329.

( 0) 0)

|

| [132] |

SHI Kaifang, SHEN Jingwei, WU Yizhen, et al. Identifying and quantifying urban polycentric development in China from DMSP-OLS data and urban land data sets[J]. IEEE geoscience and remote sensing letters, 2020: 1–5.

( 0) 0)

|

| [133] |

SAGE C, AUSSEM A, ELGHAZEL H, et al. Recurrent neural network approach for table field extraction in business documents[C]//Proceedings of 2019 International Conference on Document Analysis and Recognition. Sydney, NSW, Australia, 2019: 1308–1313.

( 0) 0)

|

| [134] |

KUMAR V, KAWARE P, SINGH P, et al. Extraction of information from bill receipts using optical character recognition[C]//Proceedings of 2020 International Conference on Smart Electronics and Communication. Trichy, India, 2020: 72–77.

( 0) 0)

|

| [135] |

JANG S, CHUNG J, RAO V R. The importance of functional and emotional content in online consumer reviews for product sales: evidence from the mobile gaming market[J]. Journal of business research, 2021, 130: 583–593.

( 0) 0)

|

| [136] |

AGRAWAL P, CHAUDHARY D, MADAAN V, et al. Automated bank cheque verification using image processing and deep learning methods[J]. Multimedia tools and applications, 2021, 80(4): 5319–5350.

( 0) 0)

|

| [137] |

BANSAL B, SRIVASTAVA S. Hybrid attribute based sentiment classification of online reviews for consumer intelligence[J]. Applied intelligence, 2019, 49(1): 137–149.

( 0) 0)

|

| [138] |

WANG Bin, LONG Wen, WEI Xianhua. Investor attention, market liquidity and stock return: a new perspective[J]. Asian economic and financial review, 2018, 8(3): 341–352.

( 0) 0)

|

| [139] |

YANG Linyi, XU Yang, NG T L J, et al. Leveraging BERT to improve the FEARS index for stock forecasting[C]//Proceedings of the 1st Workshop on Financial Technology and Natural Language Processing. Macao, China, 2019:1–7.

( 0) 0)

|

| [140] |

WANG Gaoshan, YU Guangjin, SHEN Xiaohong. The effect of online environmental news on green industry stocks: the mediating role of investor sentiment[J]. Physica A: statistical mechanics and its applications, 2021, 573: 125979.

( 0) 0)

|

| [141] |

张同辉, 苑莹, 曾文. 投资者关注能提高市场波动率预测精度吗?——基于中国股票市场高频数据的实证研究[J]. 中国管理科学, 2020, 28(11): 192–205. ZHANG Tonghui, YUAN Ying, ZENG Wen. Can investor attention help to predict stock market volatility? an empirical research based on Chinese stock market high-frequency data[J]. Chinese journal of management science, 2020, 28(11): 192–205. (  0) 0)

|

| [142] |

杨涛, 郭萌萌. 投资者关注度与股票市场—以PM2.5概念股为例[J]. 金融研究, 2019(5): 190–206. YANG Tao, GUO Mengmeng. Investor attention and stock market: taking PM2.5 concept stocks as an example[J]. Financial research, 2019(5): 190–206. (  0) 0)

|

| [143] |

SUN Fan, BELATRECHE A, COLEMAN S, et al. Pre-processing online financial text for sentiment classification: a natural language processing approach[C]//Proceedings of 2014 IEEE Conference on Computational Intelligence for Financial Engineering & Economics. London, UK, 2014: 122–129.

( 0) 0)

|

| [144] |

MISHEV K, GJORGJEVIKJ A, VODENSKA I, et al. Evaluation of sentiment analysis in finance: from lexicons to transformers[J]. IEEE access, 2020, 8: 131662–131682.

( 0) 0)

|

| [145] |

OLANIYAN R, STAMATE D, PU I. A two-step optimised BERT-based NLP algorithm for extracting sentiment from financial news[C]//Proceedings of the 17th IFIP International Conference on Artificial Intelligence Applications and Innovations. Hersonissos, Crete, Greece, 2021: 745–756.

( 0) 0)

|

| [146] |

SOUSA M G, SAKIYAMA K, DE SOUZA RODRIGUES L, et al. BERT for stock market sentiment analysis[C]//Proceedings of the 31st International Conference on Tools with Artificial Intelligence. Portland, USA, 2019.

( 0) 0)

|

| [147] |

LI Menggang, LI Wenrui, WANG Fang, et al. Applying BERT to analyze investor sentiment in stock market[J]. Neural computing and applications, 2021, 33(10): 4663–4676.

( 0) 0)

|

| [148] |

LI Mingzheng, CHENG Lei, ZHAO Jing, et al. Sentiment analysis of Chinese stock reviews based on BERT model[J]. Applied intelligence, 2021, 51(7): 5016–5024.

( 0) 0)

|

| [149] |

李成刚,贾鸿业. 企业管理层的文本披露质量与上市公司的风险预警——基于公司年报文本信息的分析研究[C]//. 中国数量经济学会2019年年会. 兰州, 中国, 2019: 413–433. LI Chengang, JIA Hongye. The quality of corporate management’s text disclosure and the risk warning of listed companies: an analysis based on the text information of the company’s annual report[C]// 2019 Annual Meeting of China Society of Quantitative Economics. Lanzhou, China, 2019:413–433. (  0) 0)

|

| [150] |

姚潇, 吴冬晓, 庞守林. 基于文本挖掘的管理层语调 对公司债券信用利差的影响 [J]. 经济理论与经济管理, 2020(3): 99–112. YAO Xiao, WU Dongxiao, PANG Shoulin. The influence of management tone on corporate bond credit spread based on text mining[J]. Economic theory and business management, 2020(3): 99–112. (  0) 0)

|

| [151] |

董伟. 挖掘和分析文本来识别公司财务欺诈: 针对财务报表和社交媒体的分析 [D]. 合肥: 中国科学技术大学, 2016. DONG Wei. Mining and analyzing the text for corporate fraud detection: an investigation of financial statements and social media[D]. Hefei: University of Science and Technology of China, 2016. (  0) 0)

|

| [152] |

LI Xuerong, SHANG Wei, WANG Shouyang. Text-based crude oil price forecasting: a deep learning approach[J]. International journal of forecasting, 2019, 35 (4):1548–1560.

( 0) 0)

|

| [153] |

ZHAO Lutao, ZENG Guanrong, WANG Wenjing, et al. Forecasting oil price using web-based sentiment analysis[J]. Energies, 2019, 12(22): 4291–4309.

( 0) 0)

|

| [154] |

杨兵, 杨杨. 企业家市场预期能否激发税收激励的企业研发投入效应——基于上市企业年报文本挖掘的实证分析[J]. 财贸经济, 2020, 41(6):37–52. YANG Bing, YANG Yang. Whether entrepreneur market expectation can stimulate enterprise R & D investment effect of Tax incentive -an empirical analysis based on text mining of annual reports of listed enterprises [J]. Finance and trade economy, 2020, 41 (6): 37–52. (  0) 0)

|

| [155] |

部慧, 姚磊, 李映森. 沪深300 ETF上市对股指期货价格发现功能动态变化的影响:考虑交易机制变化[J].计量经济学报,2021,1(3):655–669. BU Hui, YAO Lei, LI Yingsen. The impact of listing of CSI 300 ETF on the dynamic change of stock index futures price discovery function: considering the change of trading mechanism [J]. Journal of econometrics, 2021,1 (3): 655–669. (  0) 0)

|

| [156] |

LIU Jue, LU Zhuocheng, DU Wei. Combining enterprise knowledge graph and news sentiment analysis for stock price prediction[C]//Proceedings of the 52nd Hawaii International Conference on System Sciences. Grand Wailea, Maui, Hawaii, USA, 2019, 1247–1255.

( 0) 0)

|

| [157] |

ELNAGDY S A, QIU Meikang, GAI Keke. Understanding taxonomy of cyber risks for cybersecurity insurance of financial industry in cloud computing [C]//Proceedings of the 3rd International Conference on Cyber Security and Cloud Computing. Beijing, China, 2016: 295–300.

( 0) 0)

|

| [158] |

RUDNIK C, EHRHART T, FERRET O, et al. Searching news articles using an event knowledge graph leveraged by wikidata[C]//Companion Proceedings of the 2019 World Wide Web Conference. San Francisco, USA, 2019: 1232–1239.

( 0) 0)

|

| [159] |

CIAMPAGLIA G L, SHIRALKAR P, ROCHA L M, et al. Computational fact checking from knowledge networks[J]. PLoS one, 2015, 10(6): e0128193.

( 0) 0)

|

| [160] |

VAN BELLE R, MITROVIĆ S, DE WEERDT J. Representation learning in graphs for credit card fraud detection[C]//Proceedings of the 4th Workshop on Mining Data for Financial Applications. Würzburg, Germany, 2019: 32–46.

( 0) 0)

|

| [161] |

SHEN Yuming, GUO Caichan, LI Huan, et al. Financial feature embedding with knowledge representation learning for financial statement fraud detection[J]. Procedia computer science, 2021, 187: 420–425.

( 0) 0)

|

| [162] |

YANG Shuo, ZHANG Zhiqiang, ZHOU Jun, et al. Financial risk analysis for SMEs with graph-based supply chain mining[C]//Proceedings of the 29th International Joint Conference on Artificial Intelligence. Yokohama, Japan, 2020:4661–4667.

( 0) 0)

|

| [163] |

LIU Ziqi, CHEN Chaochao, YANG Xinxing, et al. Heterogeneous graph neural networks for malicious account detection[C]//Proceedings of the 27th ACM International Conference on Information and Knowledge Management. Torino, Italy, 2018: 2077–2085.

( 0) 0)

|

| [164] |

KUMAR G, JAIN S, SINGH U P. Stock market forecasting using computational intelligence: a survey[J]. Archives of computational methods in engineering, 2021, 28(3): 1069–1101.

( 0) 0)

|

| [165] |

O BUSTOS O, POMARES-QUIMBAYA A. Stock market movement forecast: a Systematic review[J]. Expert systems with applications, 2020, 156: 113464.

( 0) 0)

|

| [166] |

CAO Yuan, WU Desheng, LI Lei. Debt risk analysis of non-financial corporates using two-tier networks[J]. Industrial management & data systems, 2020, 120(7): 1287–1307.

( 0) 0)

|

| [167] |

PATRA A, DAS S, MISHRA S N, et al. An adaptive local linear optimized radial basis functional neural network model for financial time series prediction[J]. Neural computing and applications, 2017, 28(1): 101–110.

( 0) 0)

|

| [168] |

ZHANG Yuanyuan, CHOUDHRY T. Forecasting the daily time‐varying beta of european banks during the crisis period: comparison between GARCH models and the Kalman filter[J]. Journal of forecasting, 2017, 36(8): 956–973.

( 0) 0)

|

| [169] |

SHEPPARD K, XU Wen. Factor high-frequency-based volatility (HEAVY) models[J]. Journal of financial econometrics, 2019, 17(1): 33–65.

( 0) 0)

|

| [170] |

ALEXANDRIDIS A K, HASAN M S. Global financial crisis and multiscale systematic risk: evidence from selected European stock markets[J]. International journal of finance & economics, 2020, 25(4): 518–546.

( 0) 0)

|

| [171] |

DING Qiaoying. Risk early warning management and intelligent real-time system of financial enterprises based on fuzzy theory[J]. Journal of intelligent & fuzzy systems, 2021 (6): 1–11.

( 0) 0)

|

| [172] |

HILSCHER J, WILSON M. Credit ratings and credit risk: Is one measure enough[J]. Management science, 2016, 63(10): 3414–3437.

( 0) 0)

|

| [173] |

DE SANTIS R A. Unobservable systematic risk, economic activity and stock market[J]. Journal of banking & finance, 2018, 97: 51–69.

( 0) 0)

|

| [174] |

GARCIA-JORCANO L, SANCHIS-MARCO L. Systemic-systematic risk in financial system: a dynamic ranking based on expectiles[J]. International review of economics & finance, 2021, 75: 330–365.

( 0) 0)

|

| [175] |

LI A W, BASTOS G S. Stock market forecasting using deep learning and technical analysis: a systematic review[J]. IEEE access, 2020, 8: 185232–185242.

( 0) 0)

|

| [176] |

DE SILVA A M, DAVIS R I A, PASHA S A, et al. Forecasting financial time series with grammar‐guided feature generation[J]. Computational intelligence, 2017, 33(2): 241–261.

( 0) 0)

|

| [177] |

BOROVKOVA S, TSIAMAS I. An ensemble of LSTM neural networks for high‐frequency stock market classification[J]. Journal of forecasting, 2019, 38(6): 600–619.

( 0) 0)

|

| [178] |

LI Xiaodong, WU Pangjing, WANG Wenpeng. Incorporating stock prices and news sentiments for stock market prediction: a case of Hong Kong[J]. Information processing & management, 2020, 57(5): 102212.

( 0) 0)

|

| [179] |

VARGAS M R, DE LIMA B S L P, EVSUKOFF A G. Deep learning for stock market prediction from financial news articles[C]//Proceedings of 2017 IEEE International Conference on Computational Intelligence and Virtual Environments for Measurement Systems and Applications. Annecy, France, 2017: 60–65.

( 0) 0)

|

| [180] |

ZHANG Qian, SPURGEON S, XU Li, et al. Computational intelligence in data-driven modelling and its engineering applications[J]. Mathematical problems in engineering, 2018: 2576239.

( 0) 0)

|

| [181] |

LEE C Y, SOO V W. Predict stock price with financial news based on recurrent convolutional neural networks[C]//Proceedings of 2017 Conference on Technologies and Applications of Artificial Intelligence. Taipei, China, 2017: 160–165.

( 0) 0)

|

| [182] |

ONCHAROEN P, VATEEKUL P. Deep learning for stock market prediction using event embedding and technical indicators[C]//Proceedings of the 5th International Conference on Advanced Informatics: Concept Theory and Applications. Krabi, Thailand, 2018: 19–24.

( 0) 0)

|

| [183] |

ONCHAROEN P, VATEEKUL P. Deep learning using risk-reward function for stock market prediction[C]//Proceedings of the 2018 2nd International Conference on Computer Science and Artificial Intelligence. Shenzhen, China, 2018: 556–561.

( 0) 0)

|

| [184] |

VARGAS M R, DOS ANJOS C E M, BICHARA G L G, et al. Deep leaming for stock market prediction using technical indicators and financial news articles[C]//Proceedings of 2018 International Joint Conference on Neural Networks. Rio de Janeiro, Brazil, 2018: 1–8.

( 0) 0)

|

2021, Vol. 16

2021, Vol. 16